Audiences Uncovered: Reaching The Unreachables

Hello Everyone! As a reminder, we are LIVE on Substack, where you can find all of the past and future editions of our newsletter:

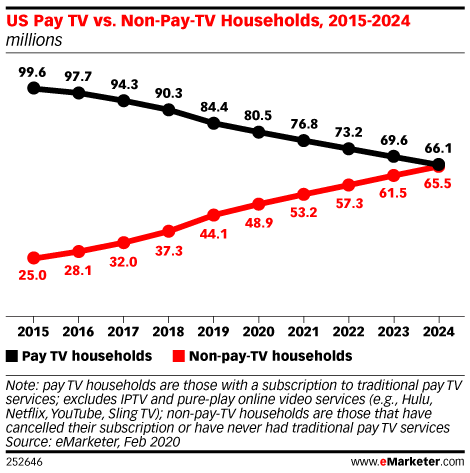

With COVID-19 further accelerating pre-existing consumption trends, we thought it was an ideal time to provide a brief overview of the Unreachables, or those among us that attempt to avoid advertising, whether through cord cutting, ad blocking, or simply turning a blind eye. This group is continuing to grow: in Q1 of this year the five largest pay TV companies saw a loss of 1.6 million US subscribers - a 70% jump from a year earlier, while Netflix and Roku (an ad-supported channel!) respectively added 15.7 and 2.9 million members over the same time period.

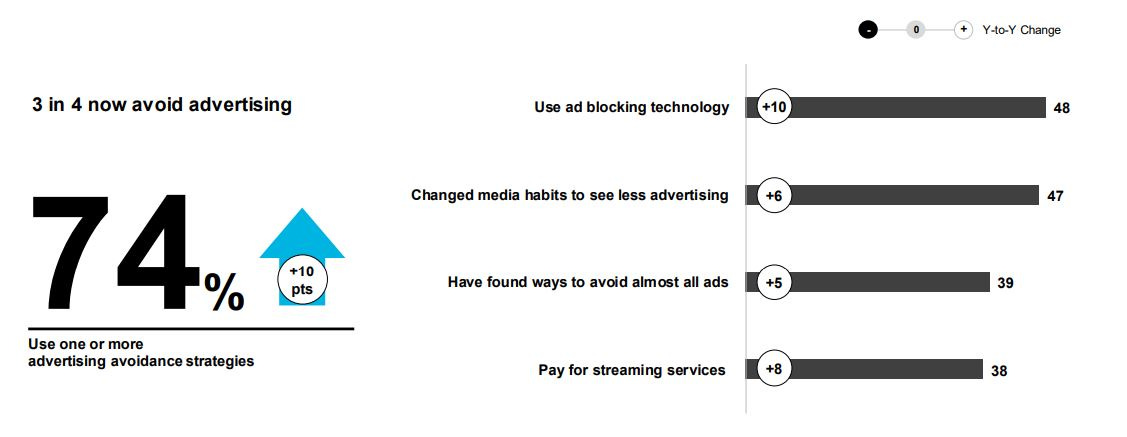

And looking more broadly, 3 in 4 global internet users report taking some action in an attempt to avoid ads (!). To really drive the point home: 74% of the global population may not get my uncle’s constant GEICO commercial references!

But wait! - before you panic - we at J3 are always monitoring the reach and frequency of our campaigns and have not yet seen any impact to delivery due to ad avoidance. In fact, digital campaigns tend to under-deliver on frequency goals suggesting an opportunity to increase investment, especially in growing channels like OTT.

This newsletter is 1,000 words, approximately a 5 minute read.

By the Numbers

49 million non-pay TV households in the U.S. (eMarketer)

47% of US Adults have reported using an ad blocker in the past month (Warc, GWI)

67% of Americans use an OTT service (eMarketer)

48% of US internet users have live streamed content in the past month (eMarketer)

$30 per month is the maximum most Americans are willing to pay for all their streaming subscriptions (eMarketer)

92 million US Adults are estimated to have listened to a Podcast in 2019 (eMarketer)

46% avoid video ads by muting, skipping, physically leaving the area, or simply ignoring (MAGNA)

Cord-Cutting in the Time of COVID

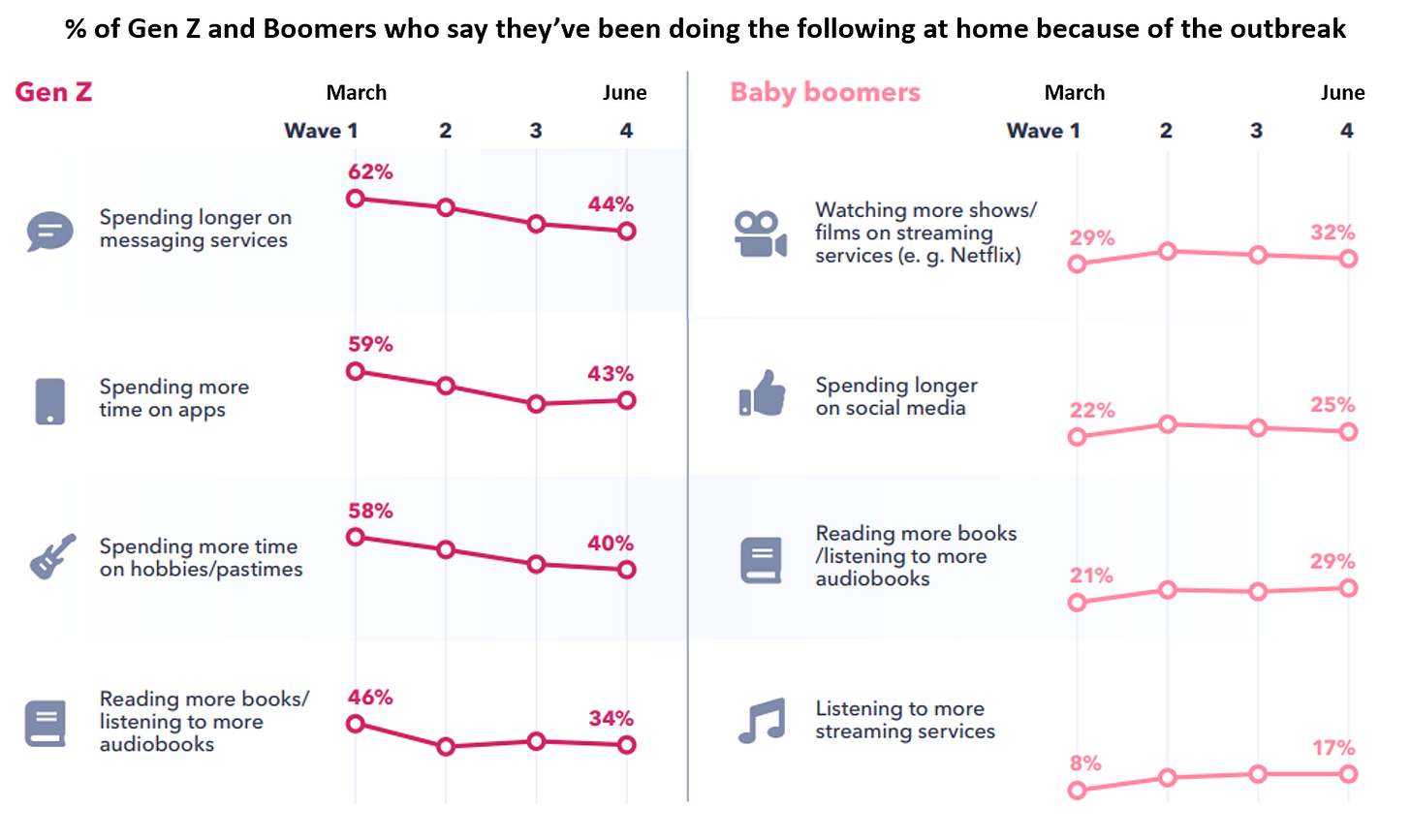

COVID’s lack of live sports coupled with continued unemployment has accelerated the # of pay-TV cancellations: 9.2% of Americans have already canceled or are planning to cancel pay-TV due to the pandemic. Subscription OTT consumption, which has increased 23% from 2019, is the top replacement activity across all Americans (even Boomers). Similar to Netflix, Disney+ has continued to add users, passing the 50 million subscriber mark in April.

But wait! - before you panic again - it’s important to note that there’s also been an increase in Ad-Supported OTT, and we have not seen a shift in share from ad-supported to subscription. Ad-Supported platforms have also been booming: the previously mentioned Roku now has 40 million active accounts.

Specialized Streaming

Niche streaming platforms were already gaining popularity before COVID, and many have since seen dramatic viewership increases as binge-happy quarantiners dive deeper into their favorite genres. Platforms like The Criterion Channel and IFC Films Unlimited, both specializing in foreign / art-house films, have seen up to 50% increases in subscribers since the beginning of the year.

These niche outfits live into the mantra: “they go wide, we go deep” - articulated by Crunchyroll’s Director of Brand Marketing Carter Hahnselle. Crunchyroll, the world’s largest Anime streaming service, is the best example of the power and scale of a supposedly ‘niche’ genre: launched way back in 2006, the service now boasts over 50 million global registered users, 2 million paying subscribers, and just this year began launching original content.

Britbox and Acorn TV are both competing to recreate this success in the British Mystery & Drama space - the latter surpassing 1 million subs in late 2019. And CuriosityStream’s focus on nonfiction documentaries has thus far resulted in 13 million paid subscribers. These niche channels may continue benefiting from COVID as production delays limit the original programming on which mainstream platforms more heavily rely - and consumers continue looking towards the deep catalogs of these more niche services.

There’s an opportunity to explore partnerships with these supposedly niche platforms - many are ad-supported - which have the potential to scale on a national or global level, and often appeal to an audience’s primary passion.

Ad Blockers

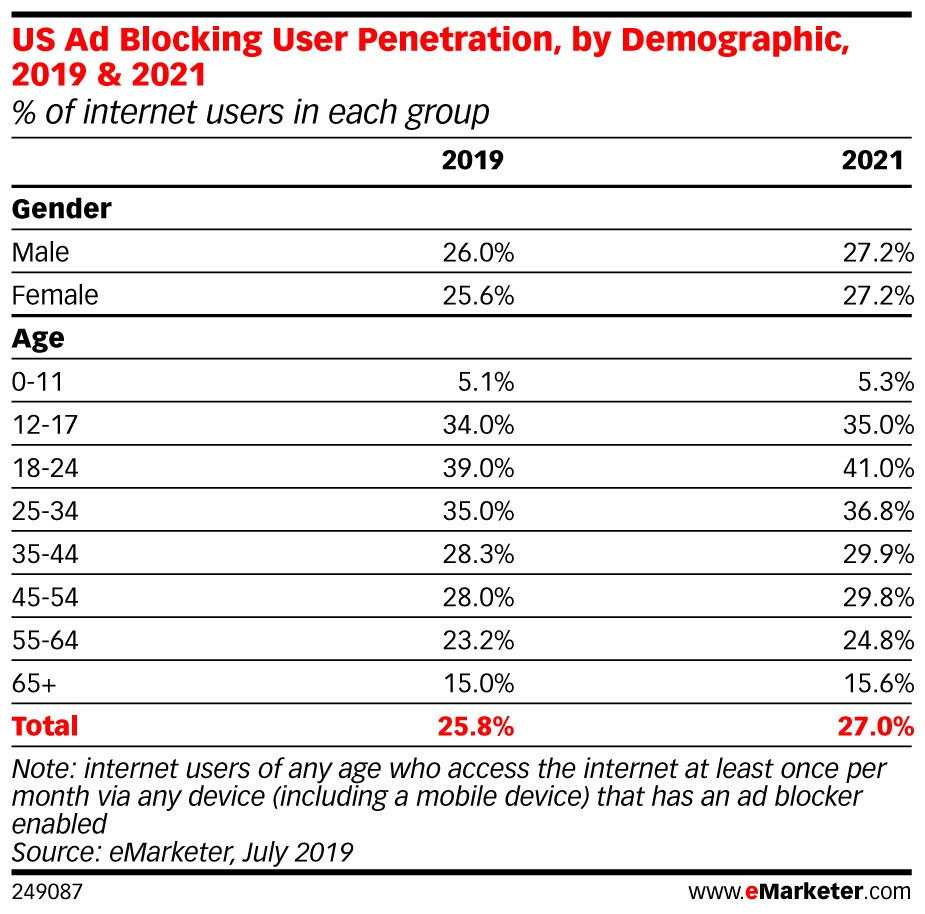

Estimates for ad blocking penetration vary significantly, with sources like Edelman and WARC reporting as many as 47% of Americans blocking an ad in the past 30 days. eMarketer estimates a much lower penetration at 26%, though does show younger demo adoption rates hovering close to 40%.

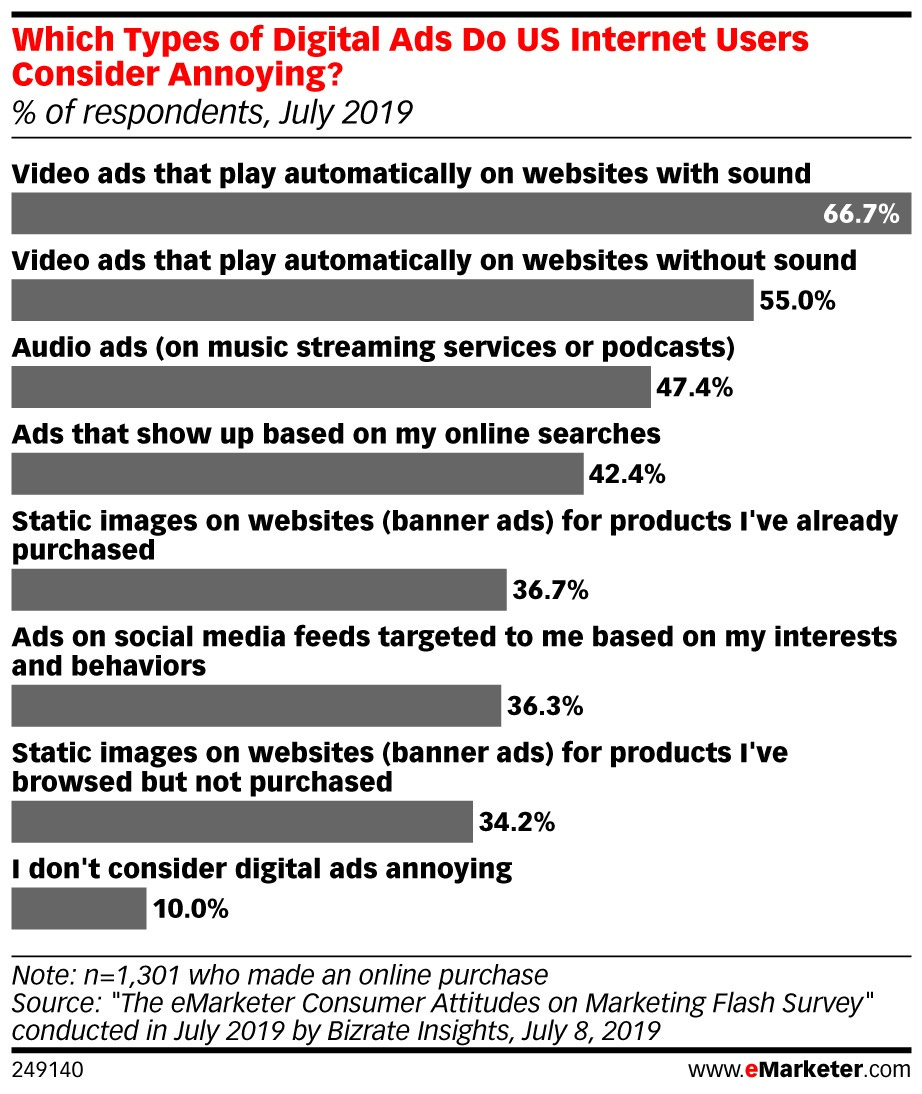

What’s their (our) issue with ads? Even above “privacy concerns”, the two most prevalent reasons are “ads are annoying” and “ads are disruptive”. More than anything, consumers want a seamless experience and a disruptive ad may be reason enough to download an ad blocker.

Thus far the most successful strategy to deal with ad blockers has come from Google, who fights ad blockers by blocking the most obtrusive ads themselves. Through their Chrome browser, Google automatically blocks all ads that violate standards set forth by their Coalition for Better Ads - their hope is that we’ll be less inclined to install a third party blocker if the most annoying ads never make it to our screens.

But wait! - before you panic a third time - at J3, we’ve always taken the approach that digital advertising shouldn’t ruin the internet. We continue to ensure our executions align with industry standards and do not interrupt the user flow for consuming content. In addition, we look for native ways to fit into the user experience through Social In-Feed & Stories experiences, which help ensure our ads reach consumers in a non-intrusive way while also combating ad blocker usage.

Ad Receptivity

When our courageous advertisements successfully make it past the latest blockers and onto the screens of our high value audience, we must then contend with the issue of ad receptivity.

To explore the factors that drive ad receptivity across digital audio & video, MAGNA & the IPG Media Lab partnered on a study entitled “Ad Receptivity, Deconstructed”. The full study is worth a read, but see below for a few highlights!

Mood Matters: All good moods monitored (excited, relaxed, focused, happy) resulted in a higher willingness to hear audio ads, whereas an excited mood most closely translated to better ad receptivity for video

Generational Divide: Gen Z’ers are least receptive to video + audio advertising, while Gen X’ers show higher receptivity, but are 32% more receptive to digital audio ads than they are to digital video ads

Parents Are Dramatically More Receptive to Ads: Millennial parents are 27% more receptive to video ads and 15% more receptive to audio ads than Millennials without children

Mastercard’s Masterclass: From Storytelling To Story-Making

It’s clear that consumers don’t like feeling disrupted, and now have the power to do something about it. It’s critical for brands to take objective measures to minimize that subjective feeling of disruption.

Mastercard has embodied these consumer trends by further emphasizing experiential marketing. They’ve shifted their focus FROM the transactional, and passively surrounding (and thereby interrupting) ‘priceless’ moments TO the experiential, and actively enabling ‘priceless’ experiences. Or as their CMO Raja Rajamannar describes it, a shift from “storytelling” to “story-making”.

No matter what the ultimate approach, reaching the unreachables begins with understanding our consumer and their mindset throughout their journey.

Is Your Brand Ready to Reach the Unreachables?

Continuing to shift from linear to Ad-Supported OTT is a great start - and even some of those more ‘niche’ platforms we described earlier, like the anime colossus Crunchyroll, have ad-supported offerings. For uncovering deeper & truly unique solutions, we recommend a quick visit to J3 Studios:

Going beyond traditional spots & sponsorships is the J3 Studios Team’s specialty. They’ve lived into the “story-making” approach described earlier through creation of original content, like the award-winning documentary 5B. During the current pandemic, they’ve continued creating branded experiences that service the needs of our HVAs, directly enabling them to connect with their passions, heroes, and each other:

OGX’s Virtual Prom: OGX and Teen Vogue teamed up to help Gen Z get hair and makeup ready for Teen Vogue’s first ever Virtual Prom. The experience included hair and makeup tutorials, positioning OGX as the hair hero for virtual prom, as well as OGX e-blasts and influencer social posts. Ultimately the experience garnered 3.9MM video views, 10.4MM impressions, and over-delivered by a value of $430K - all against an audience that is typically considered “unreachable”.

Neutrogena’s Virtual Graduation: Neutrogena partnered with media brand Her Campus to give college seniors a much-needed & star-studded virtual send-off with #ImStillGraduating. The 6-hour event included speeches & performances from a wide variety of celebrities, including Eva Longoria, Billie Jean King, Andrew Yang, the Jonas Brothers, and Liam Payne. The “surround sound” livestream ran across Facebook, Twitter, Twitch, and other channels, accumulating nearly 1.5MM live viewers with #ImStillGraduating appearing on the Twitter’s top 10 trending hashtags across the US.

Both these programs illustrate the successful “unreachable” strategy of identifying an AUDIENCE NEED and providing a BRAND SOLUTION that also amplifies BRAND PURPOSE.

During COVID, these audience needs are more overt, but these harder-to-reach audiences have daily needs, big & small, throughout their consumer journey. Uncovering those needs & brand solutions is just a brainstorm with the J3 Studios Team away! - Please shoot a note to Anthony Hello to set one up!

3 Quick Takeaways

Continue monitoring both reach & frequency: Ensure reach isn’t adversely impacted while safeguarding against over-saturation among those that don’t avoid ads

Blend into the user experience, don’t disrupt it: Look for native ways, whether through addressable or social in-feed to reach consumers in a non-intrusive way

Create experience-enabling, story-making content: Identify the audience need and provide a brand solution that also amplifies brand purpose

Extra Credit Reading

Great hub for all things related to the perpetual Streaming Wars (The Verge)

Interactive map of the exodus of talent from Hollywood studios to streaming (LA Times)

Anime Brand Crunchyroll shows the potential of niche streaming at scale (The Drum)

How small streaming services are breaking out from the pack (LA Times)

What we know about ad blocking (WARC)

Consumer Attitudes on Marketing 2019 (eMarketer)