Hello Everyone! As a reminder you can find all of the past and future editions of our Audiences Uncovered newsletter on Substack.

We are just over halfway through Hispanic Heritage Month, which began on September 15th and will end on October 15th. Last year, we published a deep dive on Hispanic American audiences and experiences as it relates to identity, culture and purchase behavior. As a follow up to that report we’ve refreshed the data and statistics for 2021, adding a new section that explores ways Hispanic/Latino audiences engage with media.

As we’ll soon uncover, Hispanic/Latino consumers are highly influential across a number of categories and are among the youngest, fastest growing and most economically powerful segments. As we strive to create meaningful connections, it is incumbent upon us to acknowledge and elevate these facts and showcase the diversity of experiences within American as well as within the Latin diaspora.

This edition of Audiences Uncovered is 1,750 words approximately a 6 min read

By the numbers

$1.9 Trillion: in Latino purchasing power (El Nuevo5)

49: percent of Latino adults who consider themselves Indigenous or Afro-Latino (Pew)

34: percent growth over 10 years in the number of Latino business owners (compared to 1% for all US) (SLEI)

62.1 Million: Estimate of the number of people in the United States as of 2020 that identify as Hispanic (Pew Research)

15.9 Billion: Views generated in August 2021 alone of Spanish-language YouTube content in the U.S. (Tubular)

245 Billion: Views generated by Spanish-language influencers in the U.S. over the last three years, compared to 8.6 billion generated by brands. (Tubular)

1 in 4: Children born between 2018-19 that have a Hispanic mom. Hispanic birthrates are steady as opposed to the declines observed in the general population.(Mintel)

44: Percent of Hispanic women present in Hispanic households, and 22% of all US households. (Mintel)

How Latin Independence lead to ‘Hispanic Heritage Month’

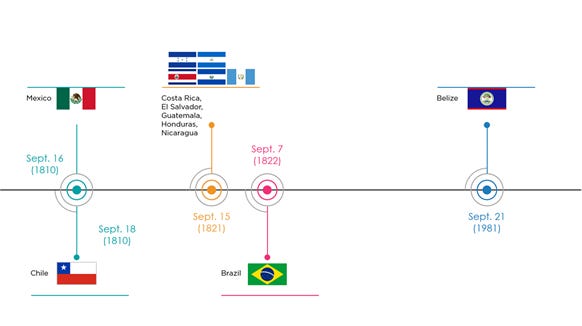

The reason Hispanic Heritage Month runs begins and ends mid-month is to account for several Latin American countries that have their Independence Day celebrations on the heels of one another (shown below).

33 years ago, in 1988, the bill extending the observance to 31 days from a week was signed into law. Esteban Torres, one of the vanguards of Latino influence in Politics, noted what he and supporters of his extension bill wanted to achieve:

“We want the American people to learn of our heritage. We want the public to know that we share a legacy with the rest of the country, a legacy that includes artists, writers, Olympic champions, and leaders in business, government, cinema, and science.”

Latino vs. Hispanic vs. Latinx

Although the gender-neutral term “Latinx” has grown in popularity in recent years — especially among younger or more progressive circles— “Hispanic” is now the term that resonates the most broadly (ThinkNow).

But, wait! There are a few nuances.

When speaking to multicultural audiences, keep this in mind.

It’s always best to ask how someone identifies and respect their personal preferences; however, marketers don’t always have that luxury. For brands looking to be sensitive, you can default to the preference of the majority. However, it’s important to consider intersections within the audience being targeted and how race and gender non-conforming subsets might feel about terms that historically have erased parts of their identities.

As a 2018 Remezcla article states, “for groups often excluded from the discourse, words like Afro-Latino, Muslim Latinos, and Asian Latinos have helped to center their experiences”.

Although “Hispanic” is a safe bet now, with a population growing younger and more multicultural, in a few years that may not be the case.

Hispanic Audiences and Media

As seen worldwide, the pandemic increased Hispanic consumer's use of digital and tech devices. However, even before 2020 Hispanics and Latinos were early adopters of tech and voracious media consumers.

The pandemic has expanded the share of Hispanics who think positively toward technology.

YouTube is a a key channel reaching 85% percent of Hispanics and Latino consumers and it checks multiple boxes.

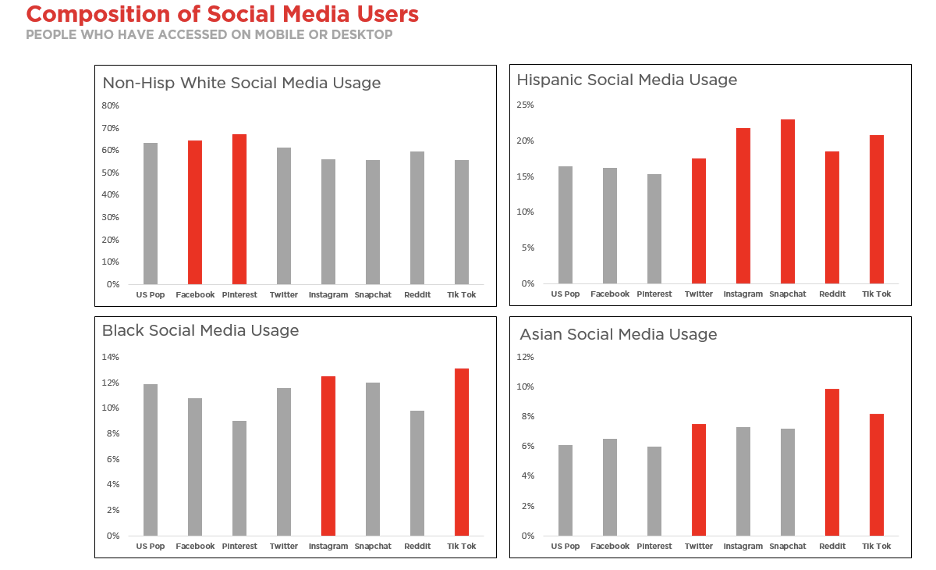

Social media channels are not just for entertainment but also act as the connective tissue to the broader community and an amplifier of information.

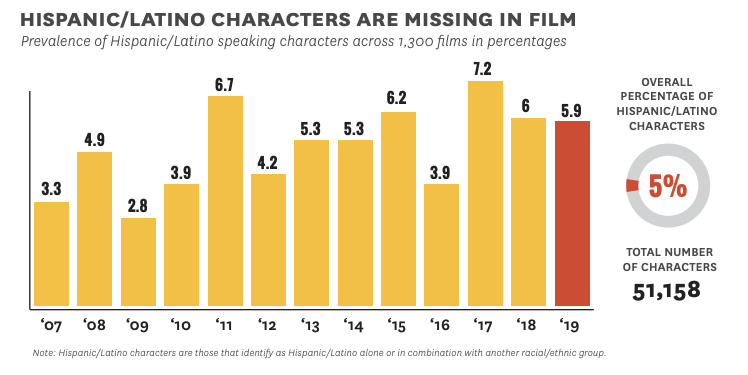

Despite being seen as extremely influential across categories, Latino representation and inclusion in Media is still lagging behind revealing that there’s much work to be done

Impact of COVID-19

2021 update: In 2020, the big story was on the disproportionate impact of COVID-19 on Latinos in America. At the time, many were also unsure about Hispanics’ overall perception of the COVID-19 vaccine and whether or not their hesitancies around inoculation would prevent them from being vaccinated.

As of September 21, 2021, the CDC has collected race/ethnicity data for a little over half of people who have received at least one dose of the vaccine (CDC). Overall data shows Hispanics accounting for 17% of the vaccinated, but among those recently vaccinated, Hispanics account for nearly one-quarter (23%), suggesting increased receptivity, likely as a result of recent vaccine mandates. However, in many states — California and Florida among them— Hispanics have received smaller shares of vaccinations compared to their shares of cases (Kaiser Family Foundation). Equally devastating, about half say a family member or close friend has been hospitalized or died from the coronavirus, and a similar share say they or someone in their household has lost a job or taken a pay cut during the pandemic. So while we are seeing some progress, there is still much to be done to bridge both healthcare and economic disparities exasperated by COVID-19.

Despite these challenges, many Hispanics maintain a positive outlook about the future. Both Pew and Nielsen have published reports this year on the optimism of the community. Perhaps this can be attributed to the way they’ve leaned into their networks for mutual support. A majority (58%) say they have helped relatives or close friends in several ways – by delivering groceries, running errands or caring for their children (39%), sending or loaning money to family or friends in another country (28%), or sending or loaning money to family or friends in the U.S. (26%), demonstrating that even in (especially in) the worst of times, it is their communities they turn to.

—

2020 Recap

To review the complete data we reported in 2020 on the impact of Covid-19 on Hispanic & Latinos, see our Hispanic AU 2020.

Latinos make up a disproportionate share of Covid-19 mortalities relative to their population.

Over represented compared to NH whites in essential workforce & dense living situations.

In the U.S., nearly 25% of employed Latino and Black or African Americans work in the service industry, compared with 16% of non-Hispanic white workers.

The psychological toll of the ongoing pandemic on Hispanics has also been harder.

Hispanic adults cite the highest instances of feelings of depression and anxiety and are less likely than the average American to feel “hopeful”.

Hispanic & Latinos as consumers

2021 update: Latino consumers wield enormous spending power, and are estimated to have contributed to 15% of sales in 2020, which equates to $121 billion. A portion of those sales was completed through online shopping as the COVID-19 pandemic raged on throughout 2020 and accelerated the adoption of online shopping.

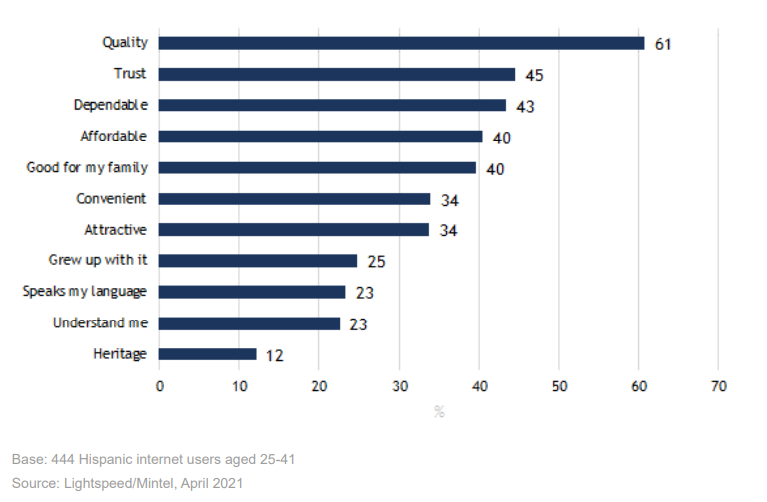

In e-commerce brands should focus their efforts on nurturing trust by ensuring the quality of product descriptions and user reviews.

There’s a key opportunity for brands to inspire loyalty by highlighting how their products are good for families.

Pew notes that 14 million Hispanics live in multigenerational households, averaging 3.24 people, which is significantly larger than the average of 2.53 observed in the US market as a whole.

44% of Hispanic households have children under age 18 living in the home. (vs 29% of all US households)

While clothing and electronics dominated online purchases, Hispanic consumers have a strong cultural foundation for beauty.

Hispanic consumers were alone in driving color cosmetics volume in 2020 and spent 13% more than the average consumer on beauty and personal care.

When looking at lip cosmetic category alone Hispanic consumers, when compared to the general population, are 1.4x more likely to buy lip cosmetics than any other group.(Nielsen IQ)

Post purchase Hispanic consumers want to keep the channels of communication open with brands and see social media as a key modality for continued connection.

Hispanics were least likely to agree that “they do not want to be reached by brands” by a significant margin (65ix)

They expect brands to follow up and are interested in providing feedback and getting product suggestions and brand-related content based on past purchases.

Social media is often a gateway for online purchases as Hispanic consumers over index (158ix) for starting their online shopping via social media.

For more on Hispanic & Latinos as consumers, see our Hispanic AU 2020.

Exploring Aspects of Latino Identity in America

In 2020, we explored in depth the meaning of Identity for Hispanic & Latino Americans. We felt it important to revisit the nuance of identity for this audience and what follows below is a recap of that section. To review it in its entirety, see our Hispanic AU 2020.

There’s breadth and depth in diversity and growth.

The Hispanic population has continued to drive overall population growth. While Mexican Americans comprise the largest share at roughly 65%, there’s also been steady growth from Guatemalans, Dominicans and Venezuelans. This new wave of Latinos are younger, more educated and more affluent.

Language can wear many hats.

57% of Latinos agree that the Spanish language is more important to them than it was five years ago

62% of Millennials report a higher interest in the language.

The 200 Percenter mentality is in.

The 200 percenters represent roughly 20 million Millennials who see themselves as 100% American and 100% Latino. What's special about this group is that they are largely the first generation that doesn't have to choose between their American and Latino identities and can outwardly claim and embrace each.

Hispanic voices are influential and far reaching.

Powerful influences of Hispanic/Latino music, politics, pop culture, style, and food, have come to be inextricable pieces of broader American culture.

What Brands Are Doing

Building brand love with Latinx Moms by creating cross-platform content that connects authentically

Goal: Drive frequency and relevance with HH moms by celebrating her culture, defining our usability, and connecting uniquely at retail

Objective: Coca-Cola sought out to create a strategic integrated marketing campaign that would build brand awareness and love among Latinx moms. The campaign was meant to shine a light using inspiring stories that highlighted authentic family connections and make Coke a continued favorite in their lives.

Program Summary: An integrated campaign led by two Latinx Influencer moms (Karla Celis and Desiree Guiterrez) shared celebrating holiday preparations, showcased how combining American customs with beloved cultural traditions passed down by their mothers and abuelas. Assets produced include:

Overall, the audience had a positive the attitude and feelings about the campaign and the brand! 17% sparking Coca-Cola brand love and intent and 15% expressing relatability with Latinx culture and traditions.

Extra credit reading

Why We Say Latinx: Trans & Gender Non-conforming People Explain (Latina)

Afro-Latino: A deeply rooted Identity Among US Hispanics (Pew Research)

Young Latinos Use Virtual Reality To Reunite Immigrant Families Separated By Borders (NBC)

Hispanic Heritage Month (History)

Latinx Writers Couldn’t Get Hollywood’s Attention. So They Came Up With Another Way (Refinery 29)

Celebrate Latinx Heritage Month By Supporting These Brands (MSN)

5 Powerful Podcasts In Honor Of Hispanic Heritage Month (Kulture Hub)